Option Greeks Complete Knowledge: Options trading has become a popular way to earn money in the stock market. Many people have turned it into a full-time profession, earning lakhs. However, making money in options trading is not easy. Making a mistake can lead to significant losses. To avoid losses, it is good to gain knowledge beforehand, understand it, and then start trading.

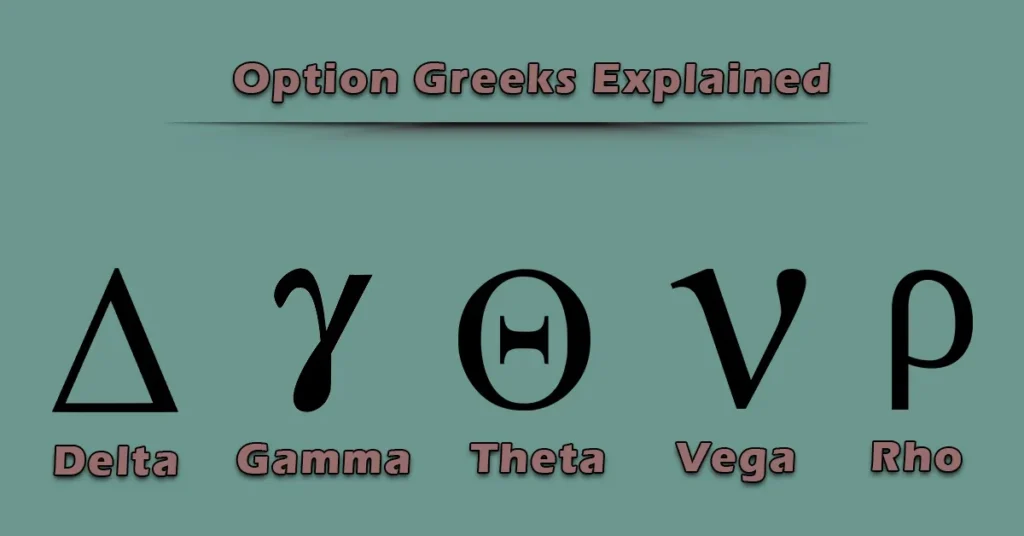

To earn in options trading, it is necessary to study some factors related to it. Some of these factors are called Option Greeks. Understanding these Option Greeks is important because they all affect the premium of options, meaning they keep changing the value of the option premium up and down. If you do not have complete information about any of the Option Greeks, then losses are certain in options trading. Option Greeks include Delta, Theta, Gamma, and Vega.

Table of Contents

ToggleOption Greeks Complete Knowledge

What are Option Greeks?

Option Greeks are factors responsible for changes in the price of option premiums. In other words, they are factors that determine the price of the option premium. Delta, Theta, Gamma, and Vega are Option Greeks that determine how much the price of an option at a certain strike price will increase or decrease.

Let’s understand the Option Greeks in detail:

Delta

Delta indicates how much the price of an option premium will increase or decrease. It shows the rate of change in the price of the option. Option Delta values range from 0 to 1, which varies at different strike prices – ITM (In The Money) being 0.5 to 1, ATM (At The Money) being 0.5, and OTM (Out The Money) being 0 to 0.5.

Theta

Theta indicates how much the price of the premium will change based on the time remaining until expiration. Market experts believe that Theta means ‘Time Value’ or ‘Time decay’. It is considered that each option has different Greeks, of which Theta is the most important. Theta is negative for option buyers but positive for option sellers.

Gamma

Gamma indicates the rate of change in Delta. It tells how much Delta will change. Gamma works only in favor of the buyer, meaning when there is a lot of uncertainty in the market, the market becomes quite volatile. In such a situation, the buyer benefits. Sellers suffer losses.

Vega

Vega indicates the change in the premium price based on the market’s volatility. When there is a lot of volatility in the market, instead of decreasing, the premium keeps increasing. It is said that Vega always works in favor of the buyer, meaning the buyer benefits when there is a lot of uncertainty in the market. Sellers suffer losses.

In options trading, it is important to know whether the call or put option is being bought or sold. It is said that Theta is negative for option buyers, but positive for option sellers. This means that Theta is in favor of the option seller.

In conclusion, understanding the Option Greeks is essential for successful options trading. Each Greek plays a crucial role in determining the value of an option premium and can help traders make informed decisions.